Historical Analysis

When the need to search for offices for rent arises, it will be important to conduct proper research into the Singapore Office Market.

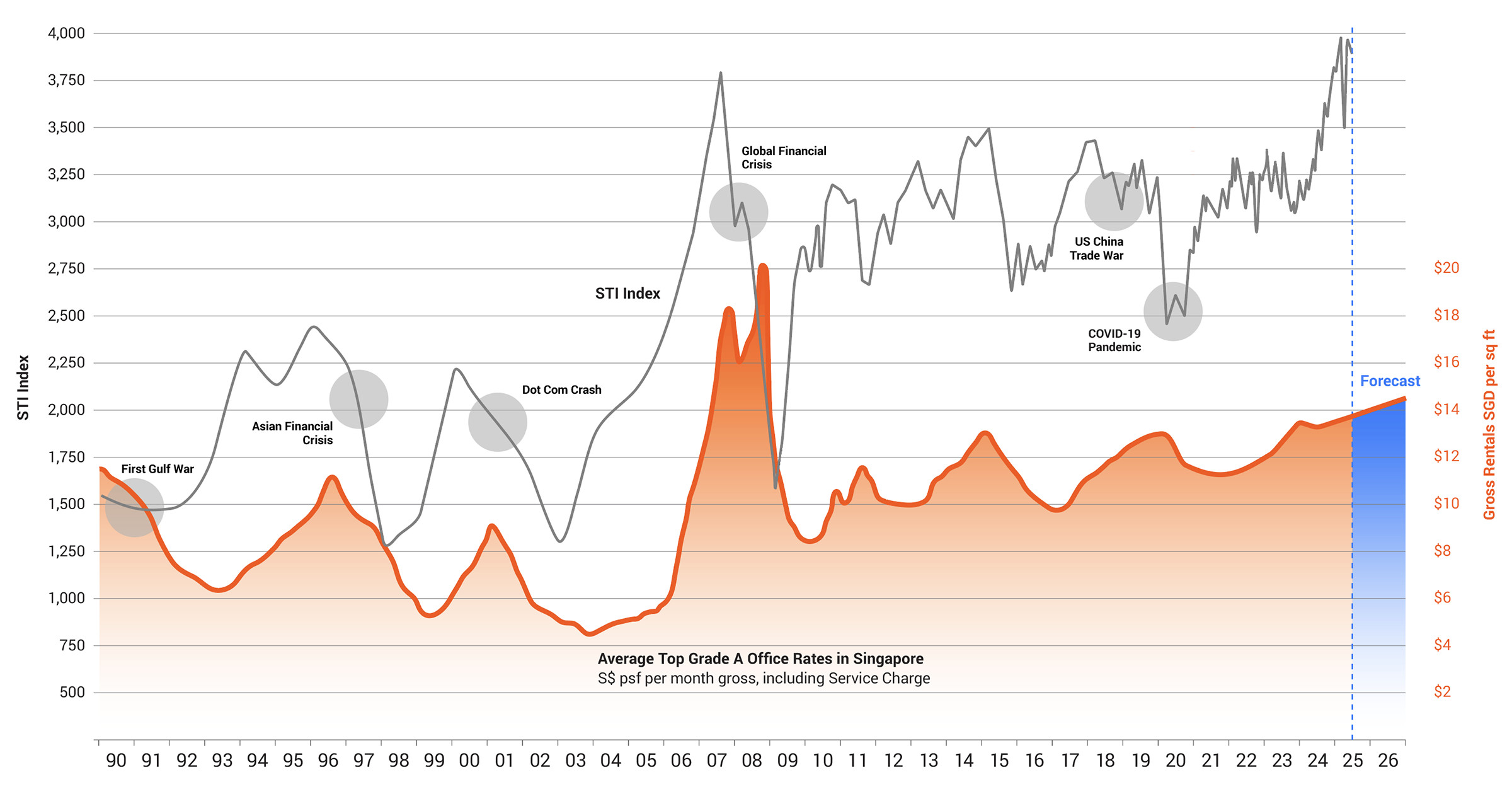

The below rental graph is a very useful and quick reference for tenants to see what part of the property cycle we are currently in, how frequent these cycles are and to assist with future planning.

Average Top Grade A Office Rates

Singapore

Last updated: July 2025

Office Rental Analysis

When the need to search for offices for rent arises, it will be important to conduct proper research into the Singapore Office Market. The above Rental graph is a very useful and quick reference to show at what stage / part of the commercial property market we are currently in.

It should be noted the stock market is often a precursor to what will happen to office rentals in the medium term future. However, there are other factors involve, other than increased demand during a market bull run and the supply of office space for lease either over supply of under supply is another important influencer. Dips in the commercial office market often occur when seismic worldwide/regional events happen, such as the stock market financial crash of Black Monday in October 1987, the Asian Financial Crisis in 1996, the Dotcom crash in 2002 and the Global Financial Crisis in 2008. The full effects of the Covid-19 pandemic have still yet to filter through.

It is therefore often useful to check the history of Singapore office rental rates to predict future office rental patterns. When looking into commercial property for rent, particularly office space for rent, it is important to determine what part of the commercial property cycle you are in at any given moment, as this can influence the timing of when to start to find offices for rent.

Our agents cover ALL buildings

To request further information or arrange a viewing, contact any one of us.